What is an iFolio?

At Ryan Investments, we know there are many ways to manage portfolios. Some managers pick stocks, some use funds. Some strategies are active while others are passive. Based on academic research, we developed an investment strategy that is appropriate for the core of most investors’ portfolio that we call iFolios. It combines the best of index funds with a risk management overlay.

We trademarked the name iFolios in 2012 to represent our unique portfolio management strategy. We build iFolios for clients with globally diversified index funds, thus the “i” in iFolios. Then we actively and constantly manage risk using systematic trading rules to limit exposure during downtrends. We’ll keep you fully-invested in rising markets for growth and, when needed, under-invested in falling markets for protection. Our ability to dually focus on growth and protection is what makes iFolios so special.

iFolios are intended to serve as the core of most investors total portfolio. For investors with enough assets, we will also recommend and manage portfolios using other strategies, third-party managers, and alternative assets. We discuss these choices on a one-on-one basis with clients, when appropriate. This section of the website is dedicated to our core strategy, iFolios.

Performance Means Growth and Protection

Index Funds

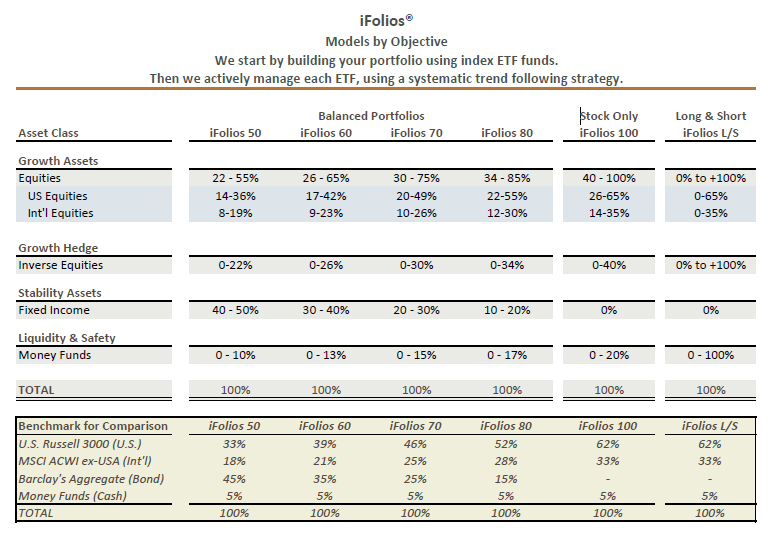

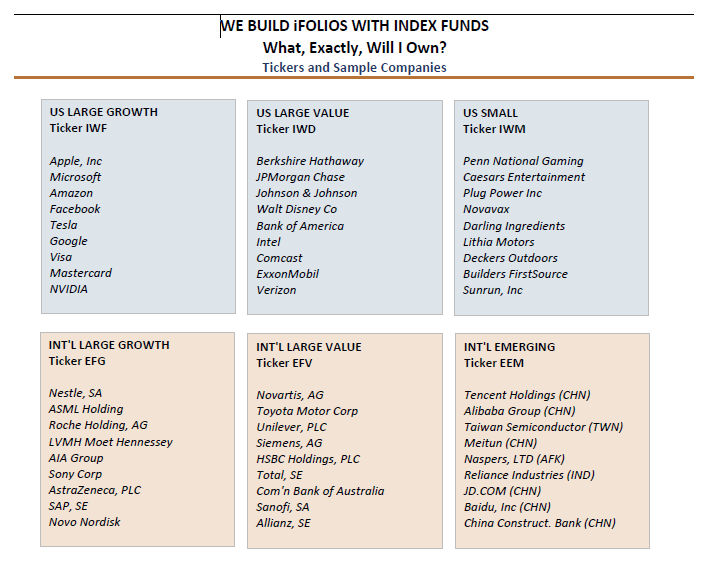

As a starting point to describe our strategy, we believe most portfolio managers have a very difficult time beating a portfolio of index funds. Index funds are liquid, low cost, and tax efficient. Numerous studies have proven that very few managers can consistently pick the right stocks or bonds to beat the market. We believe there is more value in focusing on the mix of asset classes than from stock picking. We build our clients’ iFolios with globally diversified index funds – usually 8 to 15 different index funds, representing each of the asset classes we want to include in your portfolio. You might have an index fund, for example, representing U.S. Short Term Bonds, U.S. Large Growth stocks, International Value stocks, and so on. After we’ve determined what goes into the portfolio, we’ll establish how much to invest in each index fund. Importantly, we establish an allocation range for each index fund and not just a static target to allow us to seek both growth & protection.

Trend Following

Once we’ve built your globally diversified iFolio for you, we have to manage it over time. We apply our proprietary trend following signal to track the long-term price trend of each of your index funds. When an index fund is trending higher, we’ll be fully invested within your allocation range to fully capture growth and income. On occasion, an index fund will trend lower, and we’ll trim back or sell that holding to the low end of your allocation range to provide protection from loss. It’s a systematic process that eliminates guessing and indecision.

Reporting & Feedback

Each month, we’ll provide Portfolio Review reports. These reports will review your selected iFolios model, your asset allocation, portfolio holdings, and performance. We want to continually ensure that what we’re doing for you is the right thing, that we’re doing a good job of it, and that it’s working for you to provide the growth and income you desire, within the risk tolerance you can handle.

iFolios FAQs

iFolios use globally diversified asset allocation models, low-cost index funds, and systematic rules-based trading signals. To accommodate most investors, we have developed five core models plus a long/short model. We believe iFolios should be the core of most investors total portfolio.

| Clients Served | High Net Worth and Non-Profits |

| Account Minimum (soft minimum) | $1 million investable |

| iFolios Core Models | 5 Models, customizable |

| iFolios Long/Short | Yes |

| Managed by Ryan Investments | Yes |

| Ongoing Consultation | Extensive |

| Schwab Online Access | Yes, 24/7 |

| Black Diamond Reports | Yes, monthly and on request |

| Tax Loss Harvesting | Yes |

| ESG Investing Available | Yes |

| Can Include Low Basis Holdings | Yes |

| Individual, Joint, IRAs | Yes |

| Trusts, Non-Profits | Yes |

| Getting Started | Consult With Us |

| Growth and Protection | Yes! |

| Ready to get Started? | Yes! |

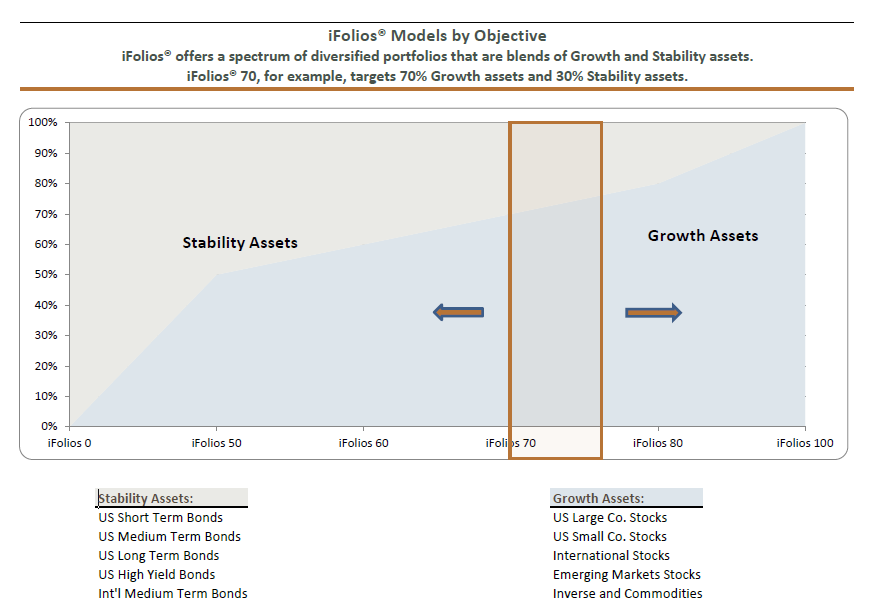

iFolios Models by Objective

What is ESG Investing?

Many investors want their money to reflect their values and request their funds to be invested in sustainable investments. Today, that means companies that meet certain Environmental, Social, and Governance (ESG) criteria. At Ryan Investments, we have been leaders in adopting ESG investing for many years and offer iFolios comprised of ESG funds. We follow the same allocation and trading strategy that we use for our core iFolios, just applied to a portfolio of ESG funds. We can you help you do well, by doing good.