Frequently Asked Questions

At Ryan Investments, we are investment managers focused on helping our clients make money, and keep it. We are asked the same questions often enough, that we created an FAQ, below:

How do you manage money?

At Ryan Investments, we manage money using our proprietary iFolios® strategy.

What’s an iFolio?

iFolios are portfolios of index funds, managed for upside growth and downside protection using a systematic, trend-following strategy.

What’s in an iFolio, what markets?

We start with considering our opportunity set. For stocks, we consider the entire world stock market as represented by the MSCI All World Stock market index. For bonds, we consider the entire world bond market, as represented by the Barclays Aggregate World index.

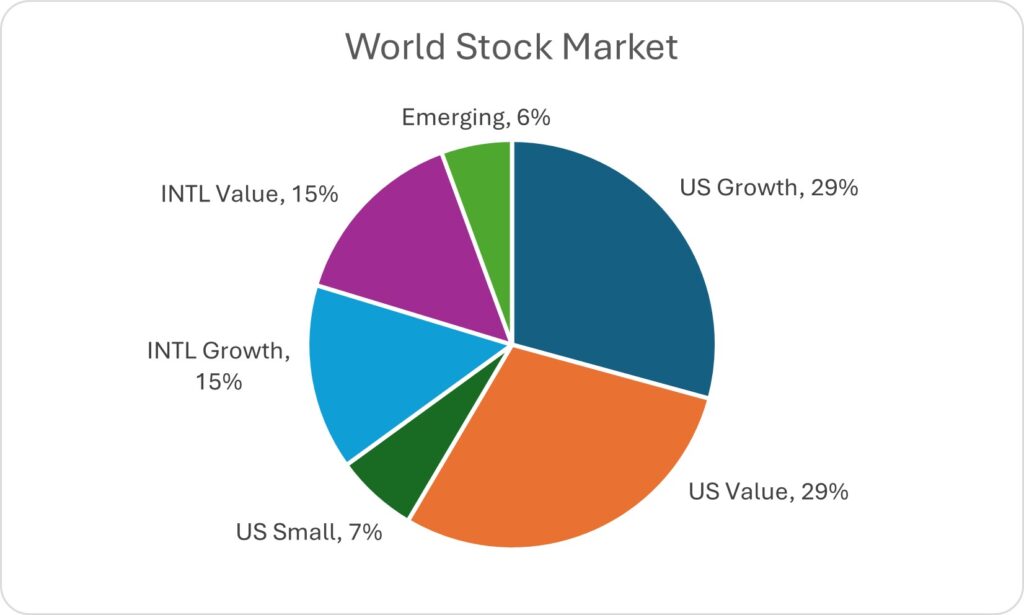

For world stocks, we closely follow the actual market capitalization of the MSCI index, as shown in the pie chart below. US stocks comprise about 65% of the world stock market index, and international stocks comprise about 35% of the world stock market index. We further divide the markets into sub-categories of growth, value, small, and emerging markets.

For world bonds, we modify the opportunity set of the Barclay’s Aggregate World index. The world market is about $130 trillion, with roughly 70% in world government bonds and 30% in world corporate bonds. Furthermore, the world bond market is dominated by the U.S., China, and Japan. Because the purpose of bonds in our iFolios is to provide stability and income, we modify our allocation to be 90% U.S. bonds and 10% International bonds. We further divide the portfolio into 50% government bonds, 30% corporate bonds, and 20% securitized bonds. All are investment grade quality.

How many different iFolios models do you offer?

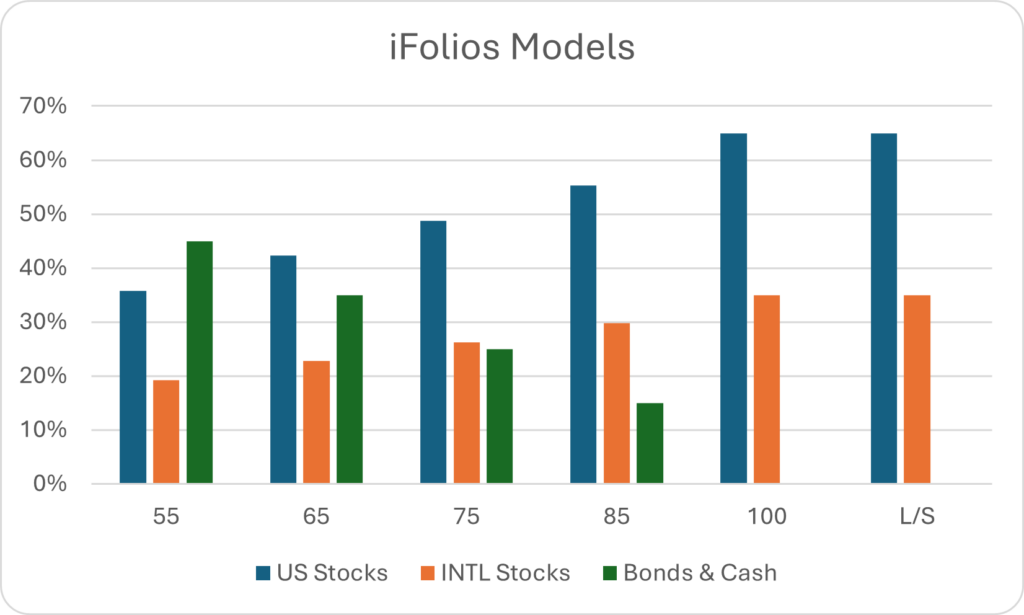

We offer six standard models so that one should be appropriate for almost every type of investor. We offer a pure global stock market model (iFolios 100), four blended stock and bond market models (iFolios 85, 75, 65, 55) and one alternative strategy (iFolios Long/Short). The iFolios number (i.e. iFolios 85) corresponds to the maximum percentage allocation to global stocks.

Do you buy & hold a static asset allocation in these six models?

No. While we believe that investors could do well to invest in a passive, globally diversified index fund portfolio, there is one major problem with this approach. The problem is “drawdowns”, which are losses incurred during a market pullback or correction.

Markets do not move in a straight line, but constantly zig and zag, both up and down. The S&P500 U.S. stock market index, for example, has averaged about 9%/year return since 1928. But it has also had 55 drawdowns of >10% along the way. And some of these 55 drawdowns have been 20%, 30%, even 50%.

What do financial advisors mean when they ask about an investor’s “risk tolerance?”

Advisors usually ask their new clients to complete a questionnaire in order to understand their objectives and risk tolerance. In finance industry jargon, risk is synonymous with volatility. But in our experience, clients think of risk as the chance of losing money. Clients don’t mind upside volatility or gains. They mind downside volatility or losses. We find that, in reality, most investors really can’t handle much more than a 10% drawdown.

Rather than present an investment’s volatility over a multi-year period, advisors should discuss the history of drawdowns and really assess whether the client is willing to tolerate them. Even if a portfolio has gained, let’s say, 8%/year on average for the past 5 years, you need to assess how volatile it was along the way. A fund that made 20% in years 1 and 2, then lost 30% in year 3, before making 20% in years 4 and 5 will have made an average of 8%/year. But can you tolerate a 30% drawdown? Imagine your $1 million dollar portfolio going down to $700,000 in year 3. This absolutely can, and does, happen to buy & hold portfolios.

What can be done to reduce losses from drawdowns?

There are only two solutions. First, you could modify your portfolio to include more conservative, low-volatility assets and less high-growth, but more volatile assets. In other words, shift to a portfolio of more bonds and less stocks. But this will likely reduce your returns, as well.

Your second solution is to use a strategy that reduces exposure to investments when they start to move lower. In other words, within your asset allocation plan, stay fully invested in the markets that are moving up and sell or trim back the markets that are moving down. Obviously, you would need a method to determine whether an asset is moving up or down. Can you do that? Yes. And that system is called “trend-following.”

How does trend-following work? Isn’t that market timing?

Trend-following is a systematic, rules-based, unemotional way to measure the trend of any asset. We use long-term moving averages to define the price trendline. When an asset is above the price trendline, we say it’s “uptrending” and should be held. When an asset moves below its price trendline, it is then “downtrending” and should be sold or trimmed to limit drawdown loss.

It’s simply a measurement, like reading the temperature on a thermometer. It’s not market timing as the industry uses the term, which refers to any system that predicts future price movements and adjusts portfolio allocations based on those predictions. Trend-following doesn’t make any predictions or guesses. A market is either currently uptrending or downtrending, simple as that.

Does the iFolios strategy use trend-following?

Yes. As described above, we start with a portfolio of index funds, with a model that is appropriate to your objectives. But we don’t buy & hold and accept the drawdowns. We use systematic trend-following and rules to determine whether to be fully invested in an index fund or under-weighted during down-trends to limit drawdown loss.

It takes constant monitoring and discipline to follow the buy and sell signals. Sometimes a trend can last many months or even years (see the chart above) and we don’t have to trade at all. But we always have to monitor and be ready and willing to trade.

How much do you sell when your trend-following rules say to sell?

Any amount will help, but we also have to consider turnover, liquidity, and taxes. We made the decision to trim back to 40% of that index fund’s target. For example, if an iFolios model calls for 20% in US Growth stocks and a downtrend sell signal is triggered, we will sell down to 8% and keep the proceeds in safe money funds until an uptrend buy signal is triggered.

Additionally, we sometimes use inverse hedges to further protect from drawdown loss when the broad market indexes are in extreme drawdowns. We allow up to 40% in hedges at times.

It sounds good, but does it work?

The strategy works if you work the strategy! We backtested our trend-following rules on our six models going back 15 years. This time frame included several major up and down markets, so long enough to evaluate how it works in all markets. While back-testing gives hypothetical results, it is a useful exercise to analyze how a strategy could work. Based on our back-tests, trend-following added about 3%/year to each of our six models and reduced drawdown losses dramatically.

Is 3%/year that big of a deal? Is it worth it?

Absolutely! If one fund earns 7%/year and it could be improved by 3%/year using trend-following to 10%/year, the compounded growth of a portfolio would be significant. At 7%, $1m would grow to $1.9m after 10 years. At 10%, $1m would grow to $2.6m. And with less volatility, the results could even be better. Finally, with less volatility and much less drawdown loss, an investor is far more likely to stick with their investment plan and not panic or quit the program after a big loss.

I’m intrigued. How do I invest?

It all starts with a conversation. We’ll meet with you to further discuss your objectives and make sure you fully understand our strategy. We’ll discuss your tolerance for drawdowns, your need for growth and/or income, and anything else that might help us do a good job for you. Check out our website at www.ryaninvest.com, email us at info@ryaninvest.com, or call us at (970) 429-1100.