Monthly Outlook: May 2025

April was a tough month for global stocks, with record volatility and whipsaw days back and forth. On April 2nd, Trump unleashed his Trump Tariff Tax program that was far bigger and broader than markets were expecting. In the following three days, the S&P500 lost over $6 trillion in value, down 14%. On April 9th, Trump suspended many of the tariffs for 90-days, surely in part due to the crashing stock market. Since then, stocks have zig-zagged higher and are nearly back to where they were on April 2nd. What a wild month! Stocks moved a total of 30% in April, 14% down and 15% up. That is not normal.

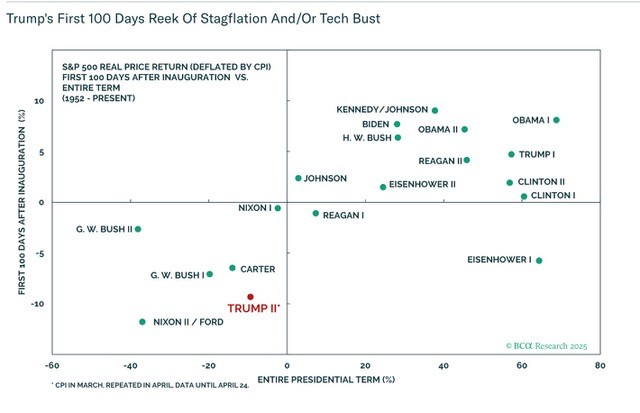

As it happens, April 30th is the end of Trump’s first 100 days in office. It’s become a common timeframe for all U.S. Presidents’ first “report card,” a tradition going back to F.D.R. in 1933. So, we have many decades for comparison. One measurement of a President’s success and the confidence of the markets is the performance of the stock market during those first 100 days. The real return of the S&P500 for Trump II is -10%, which is the second worst result going back to 1952. Only Nixon II was slightly worse, at -11%. And you’ll remember how Nixon II ended up.

Additionally, it’s worth noting that there is a strong correlation of stock market performance between a U.S. President’s first 100 days and his entire term performance. Only one President, Eisenhower I, was able to rebound from a -6% first 100 days real stock market return to a positive entire term performance. There is strong historical evidence that supports the axiom, “So goes a President’s first 100 days, goes his term.” We’d better buckle up. And we’d better take steps to prepare our portfolios for more volatility as we balance growth and protection.

Diversification Can Help Reduce Volatility

The first no-brainer step to reducing portfolio volatility is to truly diversify across a broad spectrum of asset classes or markets. US stocks, both large and small, growth and value, across most sectors makes sense. The same goes for international stocks and emerging market stocks. A portfolio of 10 Big Tech US stocks is NOT diversification. In addition to stocks, investors should consider bonds, both US and INTL, investment grade and high yield, short, medium, and long-term. For further diversification, investors could consider real estate, commodities, infrastructure, currencies, and so on. A truly globally diversified portfolio will always reduce volatility compared to each of the component markets on their own. That said, diversification can only do so much. In a global recession and bear market, even a well-diversified, global portfolio will lose value, with drawdown losses of -20%, -30%, even -50%. Diversification is a critical first step, but it’s not enough. Investors need to consider strategy, too.

Add a Strategy to Reduce Drawdowns

If you have a globally diversified portfolio and you can truly handle the inevitable large drawdowns of buying and holding such a portfolio, then by all means stop right here and carry on. But my experience is that most investors get upset with drawdowns greater than ~10%. If you want to improve your buy and hold portfolio that has repeated drawdowns of 10% or much more, you’re going to have to change your strategy to include some kind of downside protection. There are several ways to do it.

Downside protection strategies can include options, futures, sell stop orders, etc. Some of these strategies cap your upside potential in exchange for downside protection. Some only dampen drawdown risk a little but leave you exposed to loss during really bad bear markets. And some are so focused on not losing money that they never really make money, either. Lastly, you should know that financial advisors that advocate for buy and hold strategies are usually solidly against protection strategies saying that no one can “time the market” and know when to protect. That’s nonsense.

A skilled portfolio manager can always compare the price of any holding to its moving average trendline. It’s no harder than reading a thermometer. Below 32 degrees, we can know that it’s freezing. Below a moving average trendline, we can know an ETF is “downtrending.” A simple protection strategy could be to trim those holdings that are downtrending and stay fully invested in those holdings that are uptrending. In a nutshell, this is how we manage our iFolios for investors: globally diversified portfolios of low-cost ETFs combined with a strategy to reduce drawdowns. It’s time.