Monthly Outlook UPDATE: October 19, 2023

We talk about “trends” all the time and how we follow the trends to provide the growth that our investors want, and the protection that they need. Just today, the typical growth fund (which is a good proxy for what most investors own) switched from up to down, causing us to transition from growth mode to protection mode. For that reason, today is a good day to demonstrate how we invest with the trend.

Like most money managers, we build globally diversified portfolios comprised of many markets: Bonds, US Stocks, and INTL Stocks. In our case, we use one index ETF for each market. Other managers may use mutual funds or individual stocks and bonds. The vehicle isn’t as important as the method or strategy used to know 1) how much to invest in each market and 2) when to buy and sell. That’s what separates one manager from another. Some managers study economics, financial reports, sentiment studies, political views, and other forecasts to predict what markets and investments might work. Our iFolios strategy is different. We study the actual price trends of each market and invest accordingly.

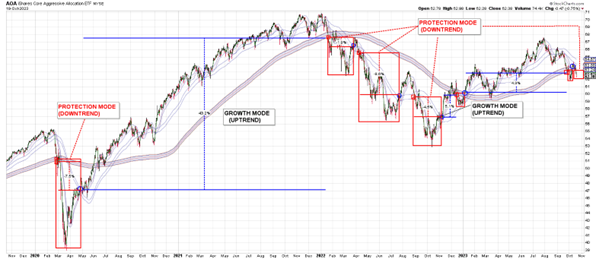

We start by defining the price trend using the 200-day moving average. Then we tweak that with a few other indicators to reduce whipsaws. With the price trend defined, we then monitor each market and use price crossovers to buy or sell. It’s systematic and rules-based, no forecasting is necessary. Let’s use the chart in the center of this page to demonstrate how we use trend-following to manage portfolios. We’ll use ticker AOA, a typical growth fund. First, we define the price trendline, which you can see as the thick and steady blue/red line. This trendline changes a little every day and is calculated for us by the charting software. Second, we watch for price crossovers to know when to buy and sell. You can see our buy signals (blue circles) and our sell signals (red squares). The chart covers four years of data. You can see the “COVID dip” in 2020 when AOA lost 7%. AOA then gave a buy signal in April 2020, and we went back to “growth mode.” It rallied 43% over the next 19 months. In 2022, the price crossed below its trendline, which triggered a series of sell signals, putting us in protection mode. Finally, AOA reversed back to an uptrend, triggering a buy signal, and it’s up about 4%, YTD.

But today, after some recent volatility, AOA triggered another sell signal as it crossed below its own price trendline. By following the trend, and using the trendline crossover to trigger buy & sell signals, you can now see how trend-following can (and does) provide both growth and protection. Rather than use one growth fund like AOA, we invest in each of its components, separately. Many of these components have just triggered sell signals, too. US Value, US Small, all INTL, and Bonds are all trending lower. We’ve already sold these markets, these ETFs, and are holding a lot of safe money funds. We’re back to protection mode. Like you, we enjoy being in “growth mode” most of the time because it offers more potential for making money. But we follow the price trend, and it says “sell.” So we have sold, and our portfolios are back in protection mode.